Creating a credit history is one of the most important steps to achieving financial freedom. A strong credit history opens the door to many opportunities – from getting approved for loans to qualifying for better interest rates and securing better terms. Lenders, landlords, and even some employers look at your credit to see if you’re reliable with money. Without a credit history, it’s hard to get approved for things like credit cards or car loans, and you may miss out on the financial opportunities that come with having a good score.

Good credit matters whether you want to buy a car, rent an apartment, or apply for a mortgage. A good credit history can mean lower monthly payments, better rental choices, and more favorable loan terms. On the other hand, a poor credit history or having no credit at all can limit your options. Many people assume you need a lot of money or experience to build credit, but the reality is that anyone can start building credit, even from scratch. The process is straightforward once you know what steps to take.

If you’re feeling overwhelmed or confused about where to start, don’t worry – it’s simpler than you might think. This guide is here to help you understand what a credit history is, why it’s so important, and how you can create a credit history step by step. Whether you’re completely new to credit or looking to improve what you already have, the information ahead will give you a clear path forward. Let’s dive in and make building credit as easy as possible!

What Is Credit History and Why Does It Matter?

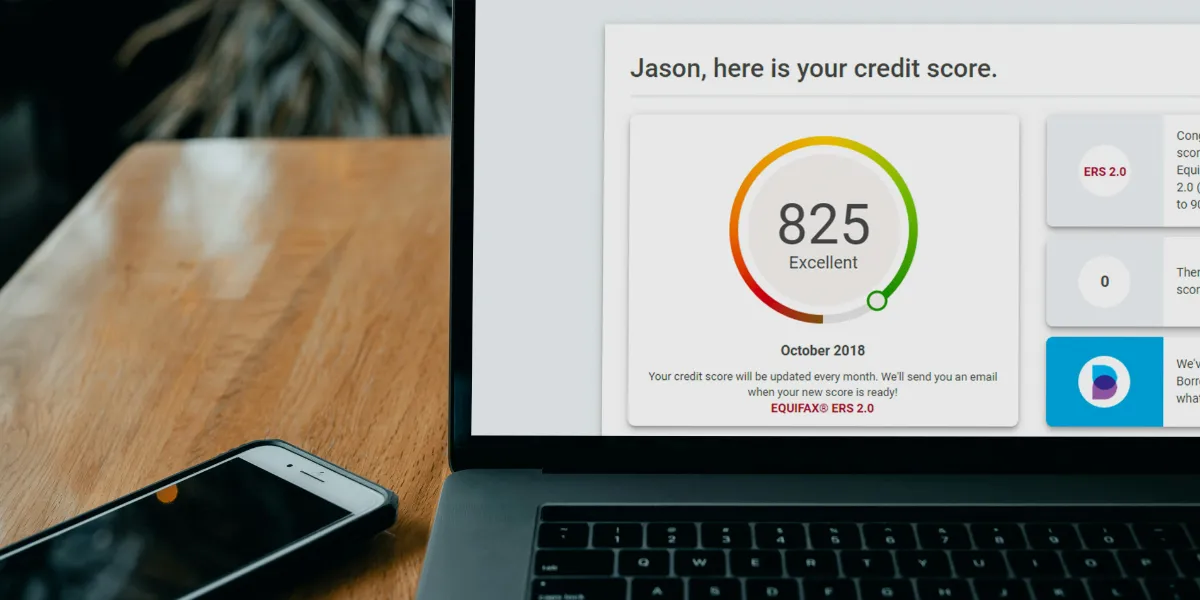

A credit history is a detailed record of how you handle borrowed money. This record includes information about any loans you’ve taken out, the credit cards you’ve used, and your history of paying bills. Every time you borrow money, whether through a credit card, student loan, or car loan, your activity is tracked and reported to credit bureaus. These bureaus compile your information into a credit report, which lenders use to assess how reliable you are when it comes to paying back debt. If you’ve never borrowed money or used credit before, you won’t have a credit history. This is called being “credit invisible,” and it can make it harder to get approved for credit cards, loans, or even to rent an apartment.

DID YOU KNOW

Creating a credit history starts as early as 18, when many individuals can apply for their first credit card or loan, impacting their financial future.

A strong credit history is crucial because it opens doors to financial opportunities. One of the biggest benefits is that it significantly increases your chances of getting approved for loans and credit cards. Lenders like to see a proven track record of responsible borrowing, and if they see that you pay your debts on time, they’re more likely to lend you money. A good credit history can also lead to lower interest rates, which saves you money in the long run. For example, a low-interest mortgage or car loan can reduce the amount you pay over the life of the loan by thousands of dollars. Besides loans, a good credit history can also help you qualify for premium credit cards with better rewards, like cashback, travel points, or lower fees.

Credit history doesn’t just affect your ability to borrow money – it can impact many other areas of your life. Some landlords will check your credit report before approving you to rent an apartment, as they want to make sure you’ll be a reliable tenant. Utility companies may also look at your credit history when setting up services, like electricity or internet, to determine if you need to pay a security deposit. In some cases, employers even check credit reports as part of the hiring process to gauge how well you manage your finances. Having no credit or poor credit can limit your opportunities in these areas, making it as restrictive as having bad credit. The good news is that building a positive credit history isn’t complicated – it just takes some planning and consistent effort, and this guide will show you how to get started.

Step-by-Step Guide to Creating a Credit History From Scratch

Ready to start creating a credit history? Follow this detailed guide, and you’ll be on your way to a strong credit history in no time.

Step 1: Open a Bank Account

Opening a checking or savings account is a simple first step toward building your credit. Although it doesn’t directly impact your credit score, it shows that you’re financially responsible and can manage money. It’s an easy way to get familiar with managing finances, which can be helpful when you start using credit. Banks often look at your banking habits when you apply for credit products, and having a positive relationship with a bank can be a stepping stone to other credit opportunities.

Why it’s important:

- It’s the foundation for other credit-building steps, as banks often offer credit cards or loans to existing customers with good banking habits.

- It demonstrates to lenders that you can handle money responsibly, which can be helpful if you apply for a loan in the future.

Step 2: Get a Secured Credit Card

If you have no credit history, a secured credit card is a smart way to get started. Unlike traditional credit cards, a secured credit card requires an upfront deposit. This deposit acts as collateral and usually matches your credit limit. For example, if you deposit $300, your credit limit will be $300. This makes it low-risk for the lender, and it’s a good way for you to demonstrate that you can handle credit. Most importantly, choose a secured card that reports to all three major credit bureaus – Equifax, Experian, and TransUnion – so your good habits are recognized.

DID YOU KNOW

Many financial experts recommend creating a credit history through a secured credit card, as it allows you to build credit with minimal risk.

Tips for using a secured credit card:

- Make small purchases regularly, like buying groceries or filling up your gas tank. This will show consistent, responsible use of credit.

- Pay off the balance in full every month. Carrying a balance isn’t necessary to build credit and will lead to interest charges.

- Look for secured cards with low annual fees and options to transition to an unsecured card after a period of good behavior.

Using a secured credit card responsibly will help you build credit history even if you’ve never borrowed before.

Step 3: Consider a Retail Store or Gas Card

If a secured credit card isn’t your style, you can apply for a retail store or gas card instead. These types of cards are often easier to qualify for if you have little to no credit history. They work like regular credit cards, but you can only use them at specific stores or gas stations. While they often come with higher interest rates, they can be a good way to establish a credit history if used wisely.

Advantages of using a retail or gas card:

- They usually have more lenient approval requirements, which can be helpful if you’re starting with no credit.

- They are useful for regular purchases like groceries or gas, which can make tracking expenses easier.

Just be sure to pay off the balance in full each month to avoid high-interest fees.

Step 4: Become an Authorized User

If you have a friend or family member with good credit, consider asking them to add you as an authorized user on their credit card. As an authorized user, you get your own card linked to the account, but the primary cardholder is ultimately responsible for the bill. This arrangement can be a great way to build credit because the card’s payment history will show up on your credit report.

Things to keep in mind:

- Choose someone who has a good credit history and regularly pays bills on time.

- Confirm that the credit card issuer reports authorized user activity to the credit bureaus. Not all companies do this, and it’s crucial for building your credit.

Being an authorized user is low-risk for you but requires trust from the primary cardholder, so use this option responsibly.

Step 5: Take Out a Credit-Builder Loan

A credit-builder loan is specifically designed to help people with no credit history build one from scratch. Unlike regular loans, you don’t receive the money upfront. Instead, the lender holds the loan amount in a secured account while you make monthly payments. These payments are reported to the credit bureaus, helping to establish your credit. Once you’ve made all the payments, you receive the money, plus any interest earned.

How a credit-builder loan works:

- You make monthly payments over a set period, such as 12 to 24 months.

- Once the loan is paid off, you receive the funds, minus any fees.

This option is low-risk and a great way to prove you can handle monthly payments.

Step 6: Get a Co-Signer for a Loan or Credit Card

If you’re having trouble getting approved for credit on your own, finding a co-signer might be the answer. A co-signer is someone, like a parent or close friend, who agrees to be responsible for the loan if you don’t pay. Lenders are more likely to approve your application with a co-signer because they have added security. However, this is a big favor to ask, so it’s important to be sure you can make the payments.

Pros and cons of using a co-signer:

- Pro: Easier to get approved for loans or credit cards.

- Con: If you miss payments, it affects both your credit score and the co-signer’s, so you need to be careful.

This option is ideal for those who have someone willing to vouch for them financially.

Step 7: Use Rent Reporting Services

You may not realize it, but paying rent on time can help you build credit if you use a rent reporting service. These services report your rent payments to the major credit bureaus, adding them to your credit history. This can be especially useful if you’re renting and don’t have other credit accounts to help build your credit profile.

Why use a rent reporting service:

- It creates a history of on-time payments, which is crucial for a strong credit score.

- It’s a good way to demonstrate financial responsibility, especially if you have limited credit options.

Check with your landlord to see if they already offer rent reporting, or you can sign up for a service yourself.

Step 8: Monitor Your Credit Utilization

Credit utilization plays a big role in your credit score. It’s the percentage of your available credit that you’re currently using. For example, if you have a credit card with a $1,000 limit and you’re using $300, your utilization is 30%. Keeping your credit utilization low – ideally below 30% – shows lenders that you’re responsible with credit.

Quick tips to manage credit utilization:

- Pay off your credit card balances before the due date each month.

- Consider asking for a credit limit increase if you have a strong payment history.

- Avoid maxing out your cards, even if you pay them off right away.

Maintaining a low credit utilization ratio is a simple but effective way to boost your credit score.

Step 9: Pay All Bills on Time

This might sound like common sense, but paying your bills on time is crucial to building a good credit history. Your payment history makes up a large part of your credit score, so even one missed payment can hurt. This applies not only to credit cards and loans but also to rent, utilities, and other bills.

How to ensure on-time payments:

- Set up automatic payments through your bank or directly with the service provider.

- Use calendar reminders or apps that notify you when a due date is coming up.

Consistency in paying bills on time will go a long way toward building a strong credit history.

Step 10: Check Your Credit Reports Regularly

Errors on your credit report can negatively impact your credit score, so it’s essential to review your reports regularly. You’re entitled to a free credit report from each of the three major credit bureaus once a year through AnnualCreditReport.com. Checking your report helps you catch any mistakes and dispute them promptly.

Where to get your credit reports:

- Visit AnnualCreditReport.com to request your free annual credit report.

- You can also directly contact the major credit bureaus – Equifax, Experian, and TransUnion.

Regularly checking your credit reports ensures that your credit history is accurate and that you’re not a victim of identity theft or fraud.

Overview of Positive and Negative Credit Behaviors

Once you start building credit, it’s crucial to understand the behaviors that impact your credit score. Some actions will positively affect your credit, while others can set you back. The following table outlines credit behaviors to adopt and avoid to make sure you’re consistently moving toward a stronger credit history.

| Positive credit behaviors | Negative credit behaviors |

| Making payments on time | Missing or making late payments |

| Keeping credit utilization below 30% | Maxing out credit cards |

| Regularly monitoring your credit report | Ignoring potential errors on credit report |

| Using a mix of credit types | Applying for too much credit at once |

| Paying off credit card balances monthly | Only making minimum payments |

By practicing positive credit habits and avoiding the negative ones, you can create a credit history that reflects your financial responsibility. Small, consistent actions like these are essential for building a strong credit score and ensuring you have access to favorable financial options in the future.

In the following sections, I’ll dive deeper into these behaviors so you’ll know exactly which steps will help you create a solid credit history quickly and which pitfalls to avoid.

Tips to Improve and Maintain a Good Credit History

Building credit is just the first step – maintaining and improving it is equally important. A solid credit history doesn’t just happen overnight; it requires consistent effort and smart strategies. Here are some practical tips to help you keep your credit in great shape and even boost your score over time.

Set Up Payment Reminders

One of the most crucial factors in maintaining a good credit history is paying bills on time. Payment history accounts for a significant portion of your credit score, so missing a single payment can have a noticeable impact. To make sure you stay on top of your bills, use payment reminders. Most banks and credit card companies allow you to set up alerts via email or text message a few days before a bill is due. You can also use reminder apps on your phone or set alarms on your calendar. This simple step can help you avoid missed payments and the late fees that come with them, making it easier to maintain a strong credit score.

Automate Your Payments

Even with reminders, life can get hectic, and it’s easy to miss a due date. That’s where automatic payments come in handy. Most banks and credit card companies allow you to set up automatic payments for either the minimum amount due or the full balance. By automating payments, you eliminate the risk of late fees and protect your credit score from the impact of a missed payment. It’s usually best to pay the full balance each month to avoid interest charges, but setting up auto-pay for at least the minimum payment will keep you safe from late fees if you’re ever short on time.

Diversify Your Credit Types

Credit diversity can improve your credit score, as it shows lenders that you can responsibly manage different types of debt. If you’ve only had experience with one form of credit, like a credit card, consider adding another type to your profile. For example, you might think about getting a small installment loan, such as a car loan or a personal loan. These loans involve fixed monthly payments and a set repayment term, which can demonstrate financial stability. Having a mix of revolving credit (like credit cards) and installment credit (like personal or auto loans) is a positive indicator to lenders, as it suggests you can handle multiple financial responsibilities.

Examples of credit types:

- Revolving credit: Credit cards, lines of credit.

- Installment credit: Car loans, student loans, mortgages, and personal loans.

Avoid Closing Old Accounts

The length of your credit history is another major factor in your credit score. A longer credit history generally translates to a higher credit score, as it gives lenders more data to assess your financial habits. For this reason, avoid closing old credit accounts, especially if they’re in good standing. Even if you don’t use an old credit card, keeping it open helps maintain your average account age, which boosts your credit score. If an old card doesn’t have an annual fee, consider leaving it open and using it occasionally for small purchases to keep the account active.

Don’t Apply for Too Much Credit at Once

When you apply for a credit card or a loan, the lender typically performs a “hard inquiry” on your credit report. Hard inquiries can temporarily lower your credit score, and too many of them in a short time can make you appear desperate for credit, which is a red flag for lenders. To avoid this, space out your credit applications over several months or even years. Aim to only apply for credit when you truly need it, and avoid opening multiple accounts at once.

Why this matters:

- Hard inquiries stay on your report: They remain for two years, so spreading out applications can reduce the impact.

- Too many applications look risky: Lenders may see frequent applications as a sign that you’re struggling financially.

Keep Your Credit Utilization Low

Credit utilization – the amount of credit you’re using compared to your credit limit – is a key factor in your credit score. A lower credit utilization rate is better for your credit health. Aim to keep your utilization below 30%, meaning you should try not to use more than 30% of your available credit limit. For example, if your credit card has a limit of $1,000, try to keep your balance under $300. Paying down balances and not carrying a high debt load shows lenders you’re financially responsible.

Quick tips for managing credit utilization:

- Pay off your credit card balance each month to keep utilization low.

- Consider asking for a credit limit increase if you’re confident you won’t overspend, which can lower your utilization ratio.

- Avoid maxing out your credit cards, as this can negatively impact your credit score.

Consider a Credit Monitoring Service

A credit monitoring service can be a valuable tool for staying on top of your credit. These services track changes in your credit report, alerting you to any updates or potential signs of identity theft. Monitoring your credit regularly can help you catch mistakes early, such as incorrect information or unexpected credit inquiries. Some services even offer tips on how to improve your score and simulate the impact of potential financial decisions. While many banks and credit cards offer free credit score tracking, paid services often provide more detailed information and additional security features.

Using these strategies can help you build a strong credit history that lasts. Maintaining good credit involves consistent habits, smart financial planning, and keeping a close eye on your credit profile. With time and patience, your credit score will improve, opening doors to better financial opportunities and more favorable interest rates.

Common Mistakes to Avoid When Building Credit

Creating a good credit history takes time and effort, but it’s easy to make mistakes that can set you back. By avoiding common pitfalls, you’ll be on the right track to building a strong credit history that works in your favor. Let’s go over some of the most frequent missteps people make when trying to build credit.

Missing Payments

Missing payments, even by just a day, can have a significant impact on your credit score. Payment history is the largest factor that determines your credit score, so even one late payment can stay on your credit report for up to seven years. To avoid missing a payment, consider setting up auto-pay for at least the minimum amount due. Another option is to use calendar reminders or alerts through your bank’s app. If you’re worried about cash flow, paying at least the minimum amount on time is better than missing a payment entirely, but aim to pay off the full balance whenever possible to avoid interest.

Maxing Out Credit Cards

Credit utilization – the percentage of your credit limit that you’re using – plays a crucial role in determining your credit score. If you max out your credit cards or keep your balances high, it signals to lenders that you might be over-reliant on credit, which can hurt your score. To keep your credit utilization low, aim to use no more than 30% of your available credit limit. For example, if your credit card limit is $1,000, try to keep your balance below $300. Paying off the full balance each month not only helps maintain a low credit utilization rate but also saves you from paying interest.

Closing Old Accounts Too Soon

It’s tempting to close old credit card accounts, especially if you’re not using them, but doing so can shorten the length of your credit history. A longer credit history is generally better for your credit score because it shows lenders that you have experience managing credit over time. Even if you don’t use an old card regularly, keeping it open can help maintain a longer average account age and boost your credit score. This is especially true for cards without an annual fee. If you must close an account, consider keeping your oldest accounts open to preserve your credit history length.

Applying for Too Many Cards at Once

Applying for multiple credit cards or loans in a short time frame can lead to several hard inquiries on your credit report. Each hard inquiry can lower your credit score by a few points, and too many inquiries at once can make you look risky to lenders. It might suggest that you’re desperate for credit or taking on too much debt at once. Space out your credit applications to avoid this problem. If you need multiple lines of credit, aim to apply for them over several months instead of all at once.

Not Checking Your Credit Reports

Many people assume their credit reports are accurate, but mistakes can happen. Errors like incorrect payment dates, unrecognized accounts, or outdated information can hurt your credit score. Regularly checking your credit reports allows you to catch and correct these mistakes before they do lasting damage. You can get a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com. Consider staggering your requests throughout the year to monitor your credit more frequently. If you find any errors, dispute them with the credit bureau to get them corrected as soon as possible.

How Your Credit History Impacts Major Financial Decisions

Your credit history plays a key role in many of life’s big financial moments. From buying a car to starting a business, a solid credit history can make all the difference. Understanding how your credit impacts these milestones can help you prepare and make smarter financial decisions. Here’s a closer look at the specific areas where your credit history matters most.

DID YOU KNOW

Creating a credit history is not just for those looking to borrow money; a good credit score can also help you land a job, as some employers check credit reports.

Buying a Car

When it comes to buying a car, your credit history is a major factor in determining what kind of financing you’ll be offered. Most people can’t pay for a car outright, so they rely on auto loans. If you have a strong credit history, you’ll likely get a lower interest rate, which can save you thousands of dollars over the course of the loan. A good credit history could also mean a larger selection of financing options, from the dealership or local banks, giving you more flexibility. On the flip side, a poor or limited credit history could result in higher interest rates or require a larger down payment. In some cases, you might even need a co-signer to secure a loan if your credit is too weak. That’s why building a solid credit history early can help you get the car you want without overpaying.

Renting or Buying a Home

Whether you’re renting an apartment or looking to buy a house, your credit history will likely be reviewed. For renters, landlords often check credit reports to see if you’ve been responsible with your finances, as this suggests you’ll be a reliable tenant. A good credit history can increase your chances of approval and may even give you leverage to negotiate better rental terms. If you’re buying a home, your credit history plays an even bigger role. Mortgage lenders rely heavily on your credit score to determine the interest rate and terms of your loan. A strong credit history can lead to better loan terms, a lower interest rate, and potentially a smaller down payment requirement. This can make a huge difference in the long run, saving you thousands over the course of a 15- or 30-year mortgage.

Applying for Personal Loans

Personal loans are often used for major expenses like home improvements, medical bills, or consolidating debt. Lenders assess your credit history to decide if you’re likely to repay the loan on time. A solid credit history can lead to faster loan approvals, lower interest rates, and better repayment terms. With good credit, you’ll have access to more lenders and better loan options, giving you flexibility in managing unexpected expenses or consolidating high-interest debt. Conversely, a poor credit history could mean higher rates, stricter repayment conditions, or outright denial, limiting your choices when you need funds the most.

Starting a Business

Launching a business often requires a significant financial investment, and many aspiring entrepreneurs rely on loans to get started. If you’re looking for funding, your personal credit history will be closely examined by lenders, especially if your business is new and lacks its own credit history. A strong credit history shows lenders that you’re capable of managing debt and making payments on time, which increases your chances of securing a business loan. Poor credit, however, can make it tough to get approved, leading to higher interest rates or the need to provide collateral. In some cases, building your personal credit is the first step before you can establish a separate credit profile for your business.

Getting the Best Credit Cards

A strong credit history opens up a world of possibilities when it comes to credit cards. If your credit is solid, you’ll have access to premium credit cards with the best rewards and perks, like travel points, cash back, or exclusive benefits. These cards often come with lower interest rates, higher credit limits, and better customer service, making them a great tool for managing everyday expenses and earning valuable rewards. With a good credit history, you can qualify for introductory 0% APR offers, allowing you to pay off big purchases without interest for a set period. However, if your credit history is limited or has negative marks, you may be stuck with basic or secured cards that offer fewer perks and higher rates. That’s why maintaining a good credit history is key to accessing the top-tier cards with the best benefits.

Tools and Resources for Building and Monitoring Credit

Building and maintaining a good credit history can be easier when you use the right tools and resources. Many online platforms and products are specifically designed to help you track your progress, understand your credit report, and guide you through the process of building strong credit habits. Below are some of the best tools available to help you on your credit-building journey:

- Free credit report services: One of the first steps in managing your credit is to know what’s on your credit report. You can access a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year at AnnualCreditReport.com. This is the official site to get your credit report without any hidden fees. Regularly reviewing your credit report is important because it allows you to catch and dispute any errors that might negatively impact your score. It’s also a great way to see how your financial behaviors are being recorded.

- Credit score monitoring tools: There are several apps and websites that provide credit score tracking and advice tailored to your financial situation. Platforms like Credit Karma and Credit Sesame offer free access to your credit score, credit monitoring, and personalized tips to help you improve your credit health. These tools can alert you to changes in your credit report, like new accounts, hard inquiries, or changes in your credit utilization. This instant feedback makes it easier to adjust your habits and see how they impact your score over time.

- Financial education resources: If you want to dive deeper into credit knowledge, websites like NerdWallet and Investopedia are valuable resources. They provide guides, articles, and expert advice on topics related to credit, budgeting, and financial management. These sites often include calculators, how-to articles, and comparisons of different credit-building products. Financial literacy is a key part of maintaining good credit, and these resources are excellent for beginners and experts alike who want to stay informed about best practices in personal finance.

- Credit-building products: There are several financial products specifically designed to help individuals establish or rebuild their credit. Secured credit cards are a popular option for those just starting out because they require a cash deposit that acts as your credit limit, making them easier to qualify for. If you prefer a non-credit-card option, credit-builder loans are small loans that are designed to be easy to pay off and primarily serve to establish a credit history. Additionally, rent-reporting services can be used to add your on-time rental payments to your credit report, helping boost your credit if you don’t yet have credit cards or loans. These credit-building products are useful tools for anyone working to create a credit history or improve a low score.

DID YOU KNOW

Utilizing rent-reporting services is a smart way of creating a credit history for those who may not have traditional credit accounts.

Conclusion to Creating a Credit History

Creating a credit history doesn’t have to be complicated, and you don’t need to start with large loans or credit cards to make a positive impact. Small steps like opening a secured credit card, taking out a small credit-builder loan, or becoming an authorized user on a trusted account can help you establish a foundation without taking on unnecessary risk. What’s important is consistency in making payments on time and keeping your credit utilization low. These seemingly small actions build up over time, setting the stage for a healthy credit history and financial reputation.

Once you’ve taken the first steps, monitoring your progress is crucial. Regularly checking your credit report, either through free services or apps, keeps you aware of any changes and allows you to spot errors that could harm your score. Watching your credit score rise as you make timely payments and avoid high balances is rewarding and shows you that your efforts are working. Monitoring tools also give you a sense of control, showing how your actions directly influence your score and reminding you that building a strong credit history is in your hands.

A strong credit history opens doors to financial opportunities, lower interest rates, and greater freedom to make big decisions, whether it’s renting a new apartment, financing a car, or even securing a mortgage. Good credit isn’t just about numbers; it’s about having options and peace of mind. Starting small today can lead to big rewards down the road. By investing in your credit journey now, you’re setting yourself up for future financial success – and you’ll thank yourself later for every small step you took to get there.