Paying taxes is something we all have to deal with, but did you know that you might be paying more than necessary? Many people overlook opportunities to reduce their taxable income through deductions, leaving money on the table. By optimizing tax deductions, you can ensure you’re keeping more of your hard-earned income in your pocket. Understanding how deductions work is key – deductions lower the amount of your income that the government can tax, meaning a smaller tax bill for you.

This article will guide you step-by-step through the process of maximizing your deductions. I’ll explore the most common tax deductions, like those for mortgage interest and charitable donations, as well as tax credits that can significantly reduce your tax burden. I’ll also dive into special deductions that apply during different life stages, from student loan interest for recent graduates to retirement savings deductions for older individuals. Plus, I’ll discuss some lesser-known strategies that can help you save even more.

By the end of this guide, you’ll have a clear understanding of how to optimize your tax deductions and lower your tax bill. Whether you’re filing taxes for the first time or looking for ways to reduce what you owe this year, these tips will help you get the most out of your tax return. Let’s dive in and make sure you’re not paying more taxes than you have to!

What Are Tax Deductions?

Tax deductions are expenses that the IRS allows you to subtract from your taxable income, which helps reduce the amount of income that can be taxed. In other words, the lower your taxable income, the less tax you’ll have to pay. These deductions can come from various everyday expenses, such as making charitable donations, paying interest on a mortgage, or covering medical expenses. Understanding how to maximize these deductions is a key part of optimizing tax deductions and keeping more of your money.

There are two main types of tax deductions: the standard deduction and itemized deductions. Each option has its own benefits, and the best one for you depends on your unique situation. Let’s dive into the differences between these two types and how they impact your taxes.

Standard Deduction vs. Itemized Deductions:

- Standard deduction: The standard deduction is a fixed amount that everyone can subtract from their income, no questions asked. The amount changes every year and depends on your filing status. For example, in 2024, the standard deduction is $14,600 for single filers, $29,200 for married couples filing jointly, and $21,900 for heads of household. This option is great if your qualifying expenses aren’t high enough to make itemizing worth it. It’s simple, fast, and the most common choice for taxpayers.

- Itemized deductions: This option lets you list out (or “itemize”) specific deductions for various expenses. These can include medical bills, mortgage interest, property taxes, charitable donations, and even certain job-related expenses. Itemizing allows you to claim more deductions if they add up to more than the standard deduction. However, it requires more paperwork and tracking, as you need to keep records of all your qualifying expenses.

So, how do you decide whether to take the standard deduction or itemize? It’s all about math. If your itemized deductions add up to more than the standard deduction, then itemizing will save you more money. If not, you’re better off sticking with the standard deduction. Understanding which option is best for you is a big part of optimizing tax deductions and making sure you’re not leaving money on the table.

Maximizing Deductions and Credits

When it comes to optimizing tax deductions, making sure you claim every possible deduction and credit is essential. Deductions reduce your taxable income, while credits directly lower the amount of tax you owe. Understanding both is key to reducing your tax bill as much as possible. Below, we’ll go through some of the most common deductions and credits you should know about and how they can help you keep more of your hard-earned money.

Common Deductions

Here are a few deductions that many people can take advantage of. These will lower your taxable income and help reduce the amount of taxes you owe.

- Charitable contributions: Donations to qualified charities are tax-deductible. This doesn’t just apply to cash donations – you can also deduct the value of items like clothes, furniture, or even a car that you donate. To claim this deduction, keep records such as receipts, bank statements, or letters from the charity. The IRS requires proof for any charitable contributions you plan to deduct, so be sure to keep proper documentation.

DID YOU KNOW

Optimizing tax deductions for charitable donations includes not just cash but also non-cash items like clothing and vehicles, if donated to qualified charities.

- Mortgage interest: If you’re a homeowner with a mortgage, you can deduct the interest you pay on your loan. Each year, your mortgage lender will send you a form (Form 1098) that details how much interest you’ve paid. You can then deduct that amount from your taxable income, which can lead to significant savings – especially in the early years of your mortgage when most of your payments go toward interest.

- Medical and dental expenses: If you have large medical expenses, you might be able to deduct a portion of them. The IRS allows you to deduct medical and dental expenses that are more than 7.5% of your adjusted gross income (AGI). For example, if your AGI is $50,000 and you spent $5,000 on medical expenses, you can deduct the amount over $3,750, which is $1,250. This can include things like doctor visits, prescriptions, and even health insurance premiums if they aren’t covered by your employer.

- State and local taxes (SALT): You can deduct up to $10,000 in state and local taxes. This includes income taxes, sales taxes, and property taxes. However, the SALT deduction is capped, so even if your state and local taxes exceed $10,000, that’s the maximum amount you can deduct.

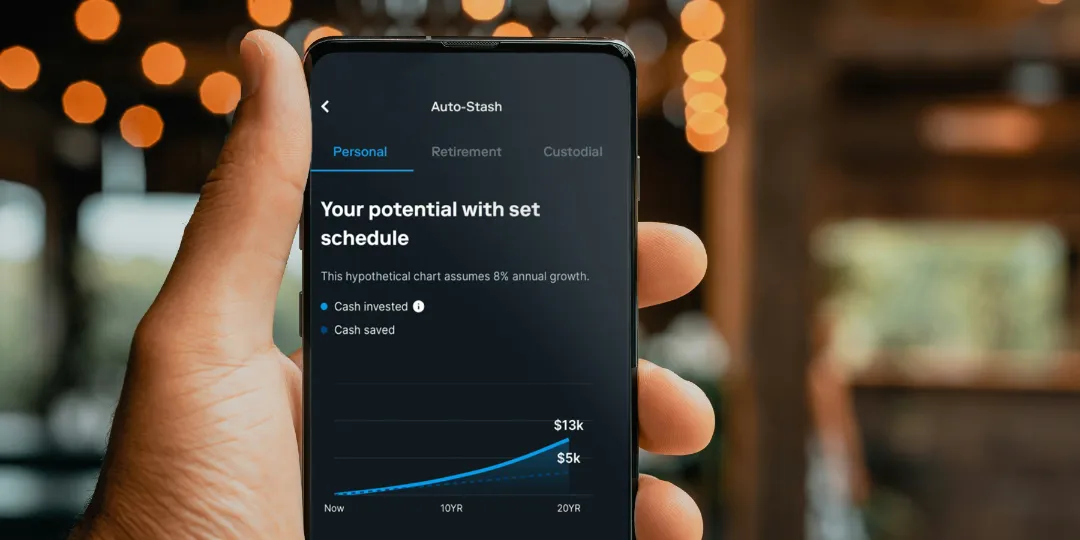

- Retirement savings contributions: Contributions to retirement accounts like a 401(k) or a traditional IRA are tax-deductible. For example, if you contribute to a 401(k) through your employer, the money is deducted from your paycheck before taxes are taken out, which lowers your taxable income. The money in these accounts grows tax-deferred, meaning you don’t pay taxes on it until you withdraw it in retirement.

Common Credits

Unlike deductions, tax credits reduce the actual amount of tax you owe, dollar-for-dollar. That makes them incredibly valuable when it comes to optimizing tax deductions and lowering your tax bill. Here are some of the most common tax credits:

- Child Tax Credit: If you have children under 17, you may qualify for a credit of up to $2,000 per child. This credit directly reduces the amount of tax you owe, and up to $1,500 of it may be refundable, meaning you can get a refund if the credit reduces your tax liability to zero.

- Earned Income Tax Credit (EITC): The EITC is designed to benefit low- to moderate-income workers, particularly those with children. The amount you can claim depends on your income and the number of children you have. For some, this credit can be worth thousands of dollars, and in many cases, it’s refundable, meaning it can result in a refund if the credit is more than the amount of taxes you owe.

- Education credits: If you or your dependents are paying for higher education, you may be eligible for education tax credits. The American Opportunity Tax Credit (AOTC) provides up to $2,500 per student for tuition and related expenses, and up to $1,000 of the credit is refundable. The Lifetime Learning Credit (LLC), on the other hand, offers up to $2,000 per tax return for tuition and related expenses. It’s worth noting that the LLC is not refundable, but it can still significantly reduce your tax bill.

By understanding and taking full advantage of these deductions and credits, you can make sure that you’re optimizing tax deductions to keep more money in your pocket. Whether it’s contributing to retirement, donating to charity, or paying for education, these options provide valuable ways to lower your tax liability.

Optimizing Tax Deduction Strategies for Different Life Stages

As you go through different stages of life, the types of tax deductions you can take advantage of may change. Knowing which deductions are available to you based on your current situation can help ensure you’re not leaving any money on the table. Optimizing tax deductions at every phase can lead to substantial savings over time. Here, we’ll break down strategies for different life stages – whether you’re single, raising a family, or a homeowner, there are specific deductions tailored for your situation.

For Individuals

If you’re single or in the early stages of your career, there are several deductions you should consider to optimize your tax savings:

- Student loan interest deduction: If you’re still paying off student loans, you’re eligible to deduct up to $2,500 in interest per year. This deduction is available whether you itemize or take the standard deduction, and it directly lowers your taxable income, which means paying less tax overall.

- Health Savings Account (HSA): If you have a high-deductible health plan (HDHP), opening an HSA can provide multiple tax benefits. Contributions to your HSA are tax-deductible, reducing your taxable income. Plus, the money you put into the account can grow tax-free, and withdrawals for qualified medical expenses are also tax-free. For those looking for long-term tax advantages, an HSA is a triple tax-saving tool.

- Retirement savings contributions: Even in your early working years, contributing to retirement accounts such as a 401(k) or IRA can yield tax benefits. Contributions to these accounts are tax-deductible, reducing your taxable income now, while the money grows tax-deferred until you retire. Optimizing tax deductions by saving for retirement early can offer compounding benefits.

For Families

If you’re raising a family, there are several tax deductions and credits available that can make a big difference when it comes to your annual tax bill. Here are a few to keep in mind:

- Child and dependent care expenses: If you’re paying for childcare so you can work or look for work, you may be able to deduct those costs. You can claim up to $3,000 in childcare expenses for one child or up to $6,000 for two or more children. This deduction can also apply if you’re paying for care for a dependent adult who lives with you, such as an elderly parent.

- Adoption Tax Credit: If you’re adopting a child, the Adoption Tax Credit can help cover some of the associated expenses, which can add up quickly. You can claim a credit of up to $14,440 per child, which can help offset adoption fees, court costs, and other related expenses. This is a nonrefundable credit, meaning it can reduce your tax bill to zero, but you won’t get a refund beyond that amount.

- Child Tax Credit: In addition to the Child and Dependent Care Expense deduction, the Child Tax Credit offers up to $2,000 per child. This credit directly reduces your tax bill, and up to $1,500 of the credit is refundable. Optimizing tax deductions for families can lead to significant savings, especially with multiple children in the household.

For Homeowners

Owning a home opens up a number of tax deduction opportunities that renters don’t have. Here’s how homeowners can optimize their deductions:

- Home office deduction: If you work from home, you may qualify for the home office deduction. You can deduct a portion of your home expenses – like rent, mortgage interest, utilities, and internet – based on the percentage of your home used exclusively for business. Keep in mind that this deduction is only available if you are self-employed or an independent contractor, and the home office space must be used solely for work purposes.

- Mortgage interest deduction: One of the biggest tax benefits for homeowners is the ability to deduct mortgage interest on loans up to $750,000. This can provide a significant deduction, especially in the early years of your mortgage when a larger portion of your payment goes toward interest. If you’re itemizing your deductions, the mortgage interest deduction can help reduce your taxable income substantially.

DID YOU KNOW

By optimizing tax deductions, many homeowners can deduct mortgage interest, reducing their overall tax burden significantly.

- Energy efficiency credits: If you’ve made energy-efficient improvements to your home, such as installing solar panels, energy-efficient windows, or other qualifying upgrades, you may be eligible for tax credits. The Residential Energy Efficient Property Credit allows you to claim a percentage of the costs for these improvements. Not only does this reduce your tax bill, but it also lowers your utility costs and benefits the environment.

For Retirees

As you near or enter retirement, there are several tax-saving strategies tailored to your new financial situation:

- Retirement account withdrawals: While saving for retirement offers tax benefits, the way you withdraw from your accounts also matters for optimizing tax deductions. Some retirement income, like withdrawals from a traditional IRA or 401(k), is taxable, so it’s important to plan these withdrawals strategically. Spreading withdrawals over several years can help avoid pushing yourself into a higher tax bracket.

- Qualified charitable distributions (QCDs): If you’re 70½ or older, you can donate up to $100,000 directly from your IRA to a qualified charity. This donation counts toward your required minimum distribution (RMD) and can be excluded from your taxable income, reducing your overall tax bill. It’s an effective way to give back while optimizing tax deductions in retirement.

- Medical expense deduction: Medical expenses tend to increase as we age, and for retirees, a higher percentage of these expenses might become deductible. As mentioned earlier, if your total medical and dental expenses exceed 7.5% of your adjusted gross income, you can deduct the excess. Keeping detailed records of your health-related expenses is crucial in retirement.

Key Takeaways for Optimizing Tax Deductions at Every Life Stage

No matter where you are in life – whether you’re just starting out, growing your family, buying a home, or enjoying retirement – there are various ways to optimize tax deductions and save money. Here’s a quick recap of how to make the most of deductions and credits at every stage:

- Individuals: Take advantage of student loan interest deductions and HSAs for tax savings.

- Families: Make sure to claim child-related credits and deductions like the Child Tax Credit and Dependent Care expenses.

- Homeowners: Maximize mortgage interest and home office deductions, along with energy efficiency credits.

- Retirees: Plan your retirement withdrawals strategically, and consider giving to charity through QCDs to reduce taxable income.

Understanding the tax deductions and credits available to you at different stages of life can help you lower your tax bill and keep more of your hard-earned money. Always consult with a tax professional to ensure you’re making the best decisions for your financial situation and staying compliant with current tax laws.

Maximizing Retirement Savings Deductions

One of the smartest ways to optimize tax deductions is by taking advantage of the various retirement savings plans available. Contributing to these accounts not only helps secure your financial future, but it can also provide immediate tax benefits by lowering your taxable income. Whether you have a 401(k), IRA, or are self-employed, there are several strategies to maximize your retirement savings deductions. Let’s break down the most popular retirement accounts and how they can help you reduce your tax bill while planning for the future.

401(k) Contributions

A 401(k) is one of the most common retirement savings plans offered by employers. It’s a tax-advantaged way to save for retirement while also reducing your taxable income during your working years. Here’s how you can optimize tax deductions with a 401(k):

- How it works: When you contribute to a traditional 401(k), the money is taken directly from your paycheck before taxes. This lowers your taxable income for the year. For example, if you earn $60,000 a year and contribute $10,000 to your 401(k), you only have to pay taxes on $50,000. You won’t pay taxes on the money in your 401(k) until you start withdrawing it in retirement.

- Employer matching: Many employers offer to match a portion of your contributions to your 401(k), which is essentially free money. For example, if your employer offers a 50% match up to 6% of your salary and you contribute 6%, your employer will contribute an additional 3%. This boosts your retirement savings without any extra cost to you. To maximize this benefit, try to contribute at least enough to get the full employer match.

- Contribution limits: For 2024, you can contribute up to $23,000 to your 401(k). If you’re 50 or older, you can also make an additional catch-up contribution of $7,500, which increases your total contribution limit to $30,000. By maxing out your contributions, you can greatly reduce your taxable income and save more for retirement.

IRA Contributions

Another excellent option for maximizing your retirement savings and optimizing tax deductions is an Individual Retirement Account (IRA). IRAs are available to anyone with earned income, and they come with significant tax advantages.

- Traditional IRA: When you contribute to a traditional IRA, your contributions are tax-deductible, meaning they reduce your taxable income for the year. For 2024, the contribution limit is $7,000, or $8,000 if you’re 50 or older. The money in a traditional IRA grows tax-deferred, and you won’t pay taxes on it until you withdraw it in retirement. If you expect to be in a lower tax bracket when you retire, a traditional IRA can help you save on taxes both now and in the future.

- Roth IRA: Contributions to a Roth IRA are not tax-deductible, meaning you don’t get an immediate tax break when you contribute. However, the money grows tax-free, and you won’t have to pay taxes when you withdraw it in retirement. This can be a good option if you expect to be in a higher tax bracket in retirement. By paying taxes upfront, you avoid paying taxes on your investment gains later. For 2024, the contribution limits for a Roth IRA are the same as for a traditional IRA – $7,000, or $8,000 if you’re over 50.

DID YOU KNOW

Contributions to retirement accounts, such as 401(k) plans and IRAs, are a key part in optimizing tax deductions for retirement planning.

Self-Employed Retirement Plans

If you’re self-employed, you have access to some powerful retirement savings plans that offer higher contribution limits and significant tax benefits. Here are two popular options:

- Solo 401(k): A Solo 401(k) is designed for business owners with no employees other than a spouse. It allows you to contribute both as an employer and an employee, which gives you a higher total contribution limit. For 2024, you can contribute up to $23,000 as an employee, plus up to 25% of your net earnings from self-employment as an employer, for a total contribution limit of up to $69,000. If you’re 50 or older, you can also make a catch-up contribution of $7,500. This plan offers a great way to maximize your retirement savings and lower your taxable income significantly.

- SEP IRA: A Simplified Employee Pension (SEP) IRA is another option for self-employed individuals or small business owners. It allows you to contribute up to 25% of your net earnings, with a maximum contribution of $69,000 for 2024. Contributions to a SEP IRA are tax-deductible, helping you reduce your taxable income. The benefit of a SEP IRA is its simplicity – there are fewer administrative requirements compared to a Solo 401(k).

Key Takeaways for Maximizing Retirement Savings Deductions

- Contributing to a 401(k) or IRA can lower your taxable income now, helping you pay less in taxes while saving for the future.

- Take advantage of employer matching in a 401(k) if it’s available – this is free money that can boost your retirement savings.

- Self-employed individuals have higher contribution limits through Solo 401(k)s and SEP IRAs, offering even more tax-saving opportunities.

Strategically contributing to retirement savings accounts can help you optimize tax deductions and build a stronger financial future. Each dollar you save for retirement not only secures your later years but also provides immediate tax benefits that can lower your current tax burden. Always remember to check the contribution limits each year and consult with a tax advisor to ensure you’re maximizing every possible deduction.

Optimizing Tax Deductions for Education Costs

Education can be expensive, but there are various tax deductions and credits available that can help make it more affordable. Whether you’re saving for a child’s future education or paying off your own student loans, these education-related tax breaks can reduce your taxable income and, in some cases, directly lower your tax bill. Understanding how to optimize tax deductions for education costs can save you a lot of money in the long run.

529 College Savings Plans

A 529 plan is a tax-advantaged savings account specifically designed for educational expenses. While contributions to a 529 plan are not federally tax-deductible, the growth in the account is tax-free, and withdrawals for qualified educational expenses are also tax-free. This makes it one of the most powerful ways to save for college or other qualified education costs.

- Qualified expenses: You can use a 529 plan to pay for college tuition, books, fees, and even room and board. In some cases, the funds can also be used for K-12 education and student loan repayments (up to certain limits). This gives you a lot of flexibility in how you use the money.

- State tax deductions: While federal tax benefits apply to how the funds grow and are withdrawn, many states offer their own tax deductions or credits for contributions to a 529 plan. Be sure to check the rules in your state, as you may be able to deduct a portion of your contributions from your state income taxes. This can make 529 plans an even more attractive option for saving for education.

- Contribution limits: There are no annual contribution limits for 529 plans, but there are limits on how much you can give as a gift before triggering federal gift taxes. In 2024, the annual gift tax exclusion is $18,000 per individual. If you’re concerned about estate planning, 529 plans allow for a special rule where you can “front-load” up to five years’ worth of contributions (up to $90,000) without incurring gift taxes.

Student Loan Interest Deduction

If you’re paying off student loans, you may be eligible for the student loan interest deduction, which allows you to deduct up to $2,500 of the interest you pay on your loans each year. This deduction directly reduces your taxable income, which can save you hundreds of dollars on your tax bill.

- Income limits: The deduction is available to individuals with a modified adjusted gross income (MAGI) below $85,000 or married couples filing jointly with a MAGI below $175,000. The deduction phases out as your income increases, so it’s important to check if you qualify based on your income level.

- Automatic deduction: One of the great things about the student loan interest deduction is that you don’t need to itemize your deductions to claim it. It’s an above-the-line deduction, which means it reduces your taxable income even if you take the standard deduction. Your loan servicer will provide you with a Form 1098-E, showing the amount of interest you paid, and if you qualify, the deduction will automatically apply when you file your taxes.

Education Credits

In addition to deductions, there are also tax credits available for education costs. Tax credits are especially valuable because they reduce the actual amount of tax you owe, not just your taxable income. The two main education credits available are the American opportunity tax credit (AOTC) and the lifetime learning credit (LLC).

- American opportunity tax credit (AOTC): This credit is worth up to $2,500 per year for each eligible student and can be claimed for up to four years of college. To qualify, the student must be enrolled at least half-time in a degree program and the credit can be used to cover expenses like tuition, fees, and course materials. Additionally, up to 40% of the credit is refundable, meaning you could receive up to $1,000 as a refund even if you don’t owe any taxes.

Key AOTC Features:- Worth up to $2,500 per eligible student per year.

- Can be claimed for up to four years of undergraduate education.

- Up to $1,000 is refundable if the credit exceeds your tax liability.

- Must be enrolled at least half-time in a qualified program.

- Lifetime learning credit (LLC): Unlike the AOTC, the Lifetime Learning Credit is not limited to undergraduate education or full-time students. The LLC is worth up to $2,000 per year, and there’s no limit on how many years you can claim it. This makes it a great option for graduate students, people taking professional development courses, or those who are enrolled part-time. The LLC can help cover tuition and related expenses at any level of education, including vocational and part-time courses.

Key LLC Features:- Worth up to $2,000 per tax return, not per student.

- Can be used for undergraduate, graduate, and vocational education.

- No limit on how many years you can claim the credit.

- Non-refundable, meaning it can reduce your tax bill but not result in a refund.

Maximizing Education Tax Benefits

To optimize your tax deductions and credits related to education, it’s important to understand how these benefits interact and ensure you’re claiming everything you qualify for. Here are a few tips:

- Coordination rules: You can’t double-dip by claiming both the AOTC and LLC for the same student in the same year, or for the same expenses. However, you may be able to use one for one student and the other for another student if you have multiple dependents in school.

- Filing status matters: Keep an eye on income limits. If you’re close to the income thresholds for the AOTC or LLC, consider contributing more to retirement accounts or making other tax-advantaged moves to lower your income and qualify for the credits.

- Keep good records: To claim education credits and deductions, you’ll need proper documentation, like tuition payment statements (Form 1098-T) from schools, receipts for course materials, and student loan interest statements (Form 1098-E).

Understanding and utilizing education-related tax deductions and credits can help you significantly lower your tax bill while investing in your or your child’s future. The key to optimizing tax deductions for education costs is to stay informed about the available options and ensure you’re taking full advantage of the tax breaks that apply to your situation.

Lesser-Known Tax Deductions and Credits

When optimizing tax deductions, it’s important to look beyond the more common deductions like charitable contributions or mortgage interest. There are lesser-known tax deductions and credits that could save you even more money. These options might apply to specific circumstances, so it’s worth digging deeper to see if they apply to your situation. Let’s go over some of these lesser-known tax-saving opportunities.

Saver’s Credit

One credit that many people overlook is the Saver’s Credit. This credit rewards low- and moderate-income earners who contribute to retirement accounts like 401(k)s, IRAs, or other qualified plans. If you’re already saving for retirement, this credit could further reduce your tax bill based on the amount of your contributions.

- Income limits: For 2024, to qualify for the Saver’s Credit, your adjusted gross income (AGI) must be below $38,250 for single filers or $76,500 for married couples filing jointly. If your income falls under these thresholds, you could be eligible for this helpful credit.

- Credit amount: The credit is a percentage of the amount you contributed to your retirement accounts during the year. Depending on your income and filing status, you could receive a credit of 10%, 20%, or even 50% of your contributions. The maximum credit you can claim is $1,000 for single filers or $2,000 for married couples. This credit not only lowers your tax bill but also incentivizes you to save for retirement.

For example, if you contributed $2,000 to your IRA and qualified for a 50% Saver’s Credit, you would receive a tax credit of $1,000. This is a direct reduction of your tax liability and a powerful way to optimize your tax deductions and credits.

Self-Employment Tax Deduction

If you’re self-employed, you’re required to pay both the employee and employer portions of Social Security and Medicare taxes, also known as self-employment tax. The good news is that you can deduct part of this tax on your personal tax return, which helps lower your taxable income.

- Deductible portion: You can deduct 50% of your self-employment tax on your federal income tax return. While this deduction doesn’t reduce your self-employment tax directly, it lowers your taxable income, which can reduce the amount of tax you owe overall.

- Business expenses: In addition to the self-employment tax deduction, you can also deduct ordinary and necessary business expenses. These include office supplies, equipment, travel, and even a portion of your home expenses if you have a home office. All these deductions combined can significantly reduce your taxable income, helping you optimize tax deductions and lower your overall tax liability.

For example, let’s say your self-employment tax for the year is $8,000. You can deduct $4,000 (50%) of that on your personal tax return, which lowers your taxable income by that amount, giving you some financial relief.

Health Insurance Premiums for Self-Employed Individuals

Another lesser-known deduction that self-employed individuals can take advantage of is the deduction for health insurance premiums. If you’re self-employed and pay for your own health insurance, you can deduct the cost of your premiums from your taxable income, even if you don’t itemize your deductions.

- Who qualifies? To qualify for this deduction, you must not be eligible for employer-sponsored health insurance through your own job or your spouse’s job. If you meet this requirement, you can deduct the full amount of your premiums from your taxable income.

- What’s deductible? You can deduct premiums for medical, dental, and long-term care insurance for yourself, your spouse, and your dependents. This deduction is valuable because it allows you to reduce your taxable income by a significant amount if you’re paying for your own health insurance.

For example, if you pay $8,000 a year for health insurance premiums and qualify for this deduction, you can deduct the entire $8,000 from your taxable income. This could make a big difference when it comes to lowering the amount of tax you owe.

Other Lesser-Known Deductions

In addition to the Saver’s Credit, self-employment tax deduction, and health insurance premium deduction, there are several other lesser-known tax breaks that can help you optimize tax deductions.

- Teacher’s classroom expenses: If you’re a teacher or educator, you can deduct up to $300 ($600 for married couples filing jointly if both are teachers) of out-of-pocket expenses for classroom supplies. This includes items like books, supplies, and even professional development costs. You don’t need to itemize to claim this deduction, and it’s available to educators who work at least 900 hours a year in elementary or secondary schools.

- Tax preparation fees: If you itemize your deductions, you can deduct the cost of tax preparation software or fees paid to a tax preparer. This deduction is typically categorized under miscellaneous itemized deductions, which must exceed 2% of your adjusted gross income (AGI) to qualify.

- State sales tax deduction: You can choose to deduct either state and local income taxes or state and local sales taxes, whichever is greater. If you live in a state without an income tax or made large purchases during the year, the sales tax deduction could be more beneficial. You don’t need to save every receipt, as the IRS provides tables with estimated deductions based on your income and location.

How to Optimize These Lesser-Known Tax Deductions

The key to optimizing tax deductions is being aware of all the potential tax breaks you qualify for, no matter how small or uncommon they may seem. Here are some tips to make sure you’re taking full advantage:

- Keep detailed records: To claim many of these deductions, you need to have proof of your expenses, such as receipts, statements, or invoices. Keeping detailed records throughout the year can make tax filing easier and ensure you don’t miss out on any deductions.

- Review IRS guidelines: Tax laws change from year to year, so it’s essential to stay updated on the latest IRS guidelines. Some deductions and credits may phase out based on income levels, and new tax breaks may be introduced. Checking IRS publications or consulting with a tax professional can help ensure you’re optimizing your tax deductions to the fullest.

- Work with a tax professional: If your financial situation is complicated or if you’re self-employed, working with a tax professional can help you uncover lesser-known deductions and credits. A tax advisor can also help you avoid errors and ensure you’re compliant with tax laws, all while saving you money.

Exploring these lesser-known tax deductions and credits can help you make sure you’re not leaving any money on the table. Whether you’re self-employed, saving for retirement, or managing your education costs, understanding these additional tax breaks is an essential part of optimizing your tax deductions and reducing your overall tax bill.

Keeping Good Records and Staying Organized

To ensure you’re optimizing tax deductions, it’s essential to keep accurate records and stay organized throughout the year. Proper documentation can make tax season much smoother and help you avoid missing out on valuable deductions. Let’s go over some simple yet effective ways to stay on top of your records and ensure you’re prepared when it’s time to file your taxes.

Keep Receipts and Documentation

The most important thing you can do to optimize your tax deductions is to keep detailed records of all deductible expenses. This includes receipts, bank statements, and any other documentation that proves you spent money on deductible items. Here are some specific examples:

- Charitable donations: If you donate to a qualified charity, keep a copy of the receipt. For donations over $250, the IRS requires written acknowledgment from the charity. If you’re donating physical goods like clothes or household items, get a written statement from the charity detailing the donation.

- Medical expenses: Save copies of any medical bills or receipts for prescription medications, doctor visits, and other eligible healthcare expenses. You can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI), so keeping detailed records is essential if you plan to take this deduction.

- Business expenses: If you’re self-employed, you’re allowed to deduct many expenses related to running your business, such as office supplies, software, internet service, travel expenses, and meals related to business meetings. Keep every receipt and make notes on them so you remember exactly what each expense was for.

Maintaining these records will allow you to confidently claim deductions and avoid any problems in case of an IRS audit. The IRS requires proof for many deductions, so staying organized will help ensure you can provide the necessary documents if needed.

Use a System for Record Keeping

Instead of waiting until tax season to gather your documents, stay organized throughout the year. Here are a few ways you can keep things in order:

- Set up folders (physical or digital):

- Create physical or digital folders for different categories of deductions like charitable donations, medical expenses, business expenses, etc.

- Store receipts and related documents in these folders throughout the year so everything is in one place when tax season arrives.

- Use an expense tracking app:

- There are several apps available that allow you to track your expenses in real-time. Many of them let you scan receipts and automatically categorize your expenses.

- Apps like QuickBooks, Expensify, or even basic budgeting tools like Credit Karma can be helpful for keeping everything organized.

- Monthly check-ins:

- Set aside time at the end of each month to review your expenses. File away receipts, record important purchases, and ensure your records are up-to-date. This small task can save a lot of time during tax season and help you spot any missing documents early.

Use Tax Software or a Tax Professional

Filing taxes can be stressful, especially if you have a lot of deductions to keep track of. Tax software or hiring a professional can help you avoid mistakes and ensure you don’t miss out on any deductions you’re eligible for.

- Tax software: Tools like TurboTax or H&R Block have made filing taxes easier for individuals and self-employed workers. These programs guide you through the process and prompt you to input deductions and credits you might qualify for, helping you optimize tax deductions without a lot of manual work. Many software options also integrate with expense-tracking apps, making it easy to import data.

- Hire a tax professional: If your taxes are more complicated, or if you’re self-employed, you might want to consider working with a tax professional. Accountants or tax preparers can help ensure that you’re not missing any deductions or credits. They stay updated on the latest tax laws and can give you personalized advice for optimizing your tax deductions.

Keeping Track of Important Tax Forms

Besides keeping receipts and records of your expenses, you’ll also receive important tax forms throughout the year. Be sure to hold onto these forms as they arrive, and store them safely for when you need them during tax season. Some common forms include:

- W-2s: If you’re an employee, you’ll receive a W-2 from your employer, which reports your annual wages and the taxes withheld from your paycheck.

- 1099s: If you’re self-employed, do freelance work, or have other sources of income (like interest or dividends), you’ll receive a 1099 form detailing how much you earned.

- Form 1098: This form reports mortgage interest you’ve paid throughout the year, which is a common deduction for homeowners.

- Form 5498: If you contribute to an IRA or other tax-advantaged retirement account, you’ll receive this form, which reports your contributions for the year.

Prepare for Tax Season Early

The sooner you start preparing for tax season, the less stressful it will be. If you’ve been keeping good records throughout the year, tax season becomes much easier because you’ll already have everything you need. Here’s a quick checklist to get ready for filing your taxes:

- Gather all your receipts and documentation for deductible expenses.

- Collect all the tax forms you’ve received from employers, financial institutions, and other sources of income.

- Make a list of all the deductions and credits you plan to claim, based on your expenses and income.

- If using tax software, start inputting your data early to catch any potential issues or missing documents before the filing deadline.

- Consider scheduling a meeting with a tax professional if your financial situation is complex or if you want expert advice on optimizing tax deductions.

Benefits of Staying Organized

Staying organized throughout the year can help you avoid the last-minute scramble of finding receipts and tax forms. More importantly, keeping good records ensures that you’re optimizing tax deductions and not missing out on any money-saving opportunities. Proper organization gives you peace of mind and allows you to focus on making smart financial decisions all year long.

Conclusion to Optimizing Tax Deductions

Optimizing tax deductions is one of the smartest strategies to lower your tax bill and hold onto more of your hard-earned money. Whether you’re claiming common deductions like mortgage interest and charitable contributions or exploring education credits and retirement savings, every deduction you take reduces your taxable income. The less income that’s taxed, the more you can save.

To get the most out of your deductions, staying organized throughout the year is key. Keeping receipts, tracking expenses, and regularly reviewing your finances ensures you don’t miss out on valuable deductions. Additionally, take the time to explore all the available tax credits that could apply to your situation, such as credits for education or retirement savings. Doing so helps you keep more money in your pocket while making the most of the tax code’s benefits.

Finally, don’t wait until the last minute. Take action now by reviewing your current tax strategy and making adjustments as needed. Whether you’re working with tax software or a professional, it’s never too early to start planning for next year’s taxes. By staying proactive and optimizing tax deductions, you’ll be well-positioned to maximize your savings and minimize your tax bill every year.